Trusts

Introduction

Trusts can be an excellent way of protecting and preserving family wealth for future generations. For many years now, they’ve been very popular in New Zealand. To put this into numbers, it is estimated that between 300,000 and 500,000 exist. Because Trusts come in many forms, it is essential that their structure is appropriate and that they’re managed correctly in order to be successful.

Want to know if a Trust is right for you and your family? Take a look at the brief overview on Trusts below. At Perpetual Guardian we also have a team of experienced professionals who are happy to help you review your current situation and discuss the best options for you.

Changes to Trust Legislation

Please note:

There have been changes to Trust legislation that you may need to know. To find out more about these changes click here.

What is a Trust?

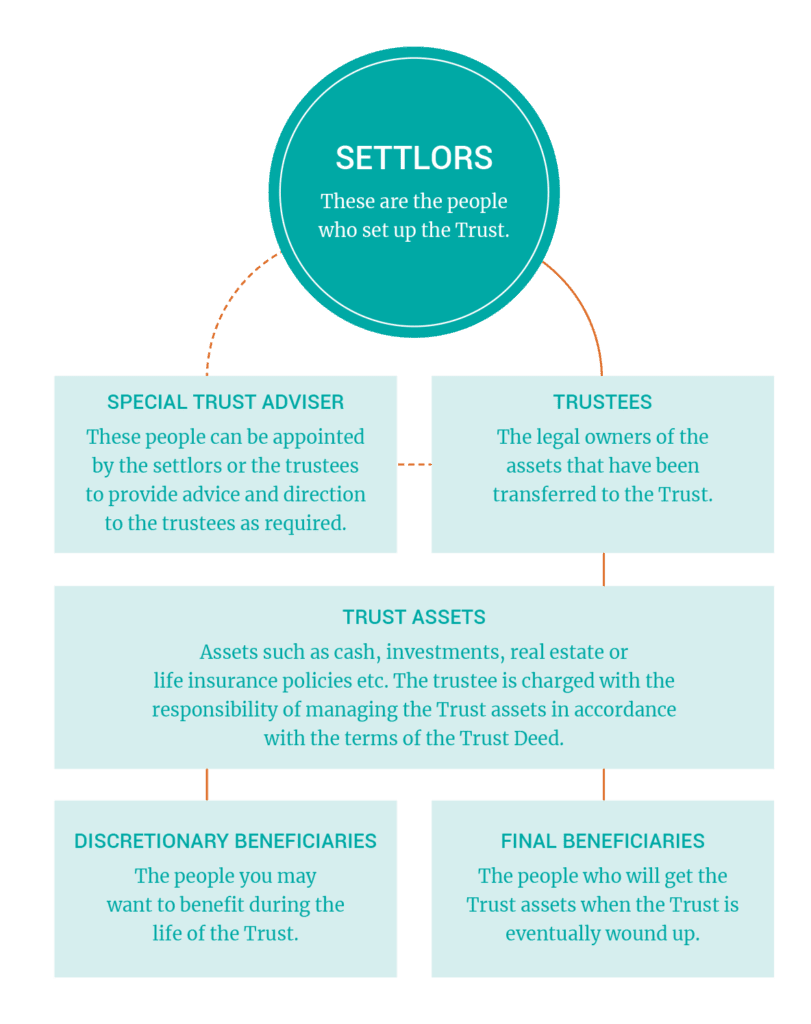

A Trust is a legally binding arrangement which requires three essential elements: a Trustee, Trust property and beneficiaries. A Trustee owns and manages the Trust’s assets. They do this ‘for the benefit of selected persons’ called beneficiaries. The person who establishes the Trust is called the Settlor.

The ‘Trust Deed’ holds all these relationships together and with the relevant legislature, serves as the operating manual for the Trustees. Trusts can be an invaluable structure to separate and protect your assets and preserve your wealth for future generations or causes that are dear to you.

Our team of experts have the knowledge, skills and experience to help you figure out how your Trust needs to be set up to meet your goals in our ever-changing world. We can help you establish a structure that best suits you and your unique circumstances and needs.